The banking sector operates at the heart of the global economy, influenced significantly by macroeconomic trends stated by Bahaa Abdul Hussein. These trends shape banking operations, affecting everything from interest rates and inflation to technological integration and regulatory frameworks.

Understanding these impacts is crucial for stakeholders within the banking industry to navigate and thrive amidst evolving economic conditions. This article delves into how various global economic trends influence banking, examining key areas such as economic cycles, technological advancements, regulatory changes, and globalization.

Global Economic Trends Influencing Banking

Economic Growth and Recession Cycles

Economic growth and recession cycles affect banking operations. During periods of economic growth, banks often experience increased lending activity as businesses expand and consumers spend more. This surge in activity leads to higher profits and more opportunities for banks to invest in new technologies and services.

Conversely, during recessions, lending activities decline due to reduced consumer spending and business investments. Banks then face higher default rates, leading to increased risk and tighter lending standards. These cyclical changes require banks to adopt flexible strategies to manage varying economic conditions effectively.

Inflation and Interest Rates

Inflation and interest rates also play pivotal roles in the banking sector. Central banks use interest rates as a tool to control inflation, influencing banks’ lending and borrowing activities. High inflation often prompts central banks to increase interest rates, making borrowing more expensive and reducing loan demand.

On the other hand, low inflation may lead to lower interest rates, encouraging borrowing and stimulating economic activity. Banks must continuously monitor inflation trends and adjust their interest rate policies accordingly to maintain profitability and manage risks associated with changing economic conditions.

Technological Advancements and Banking

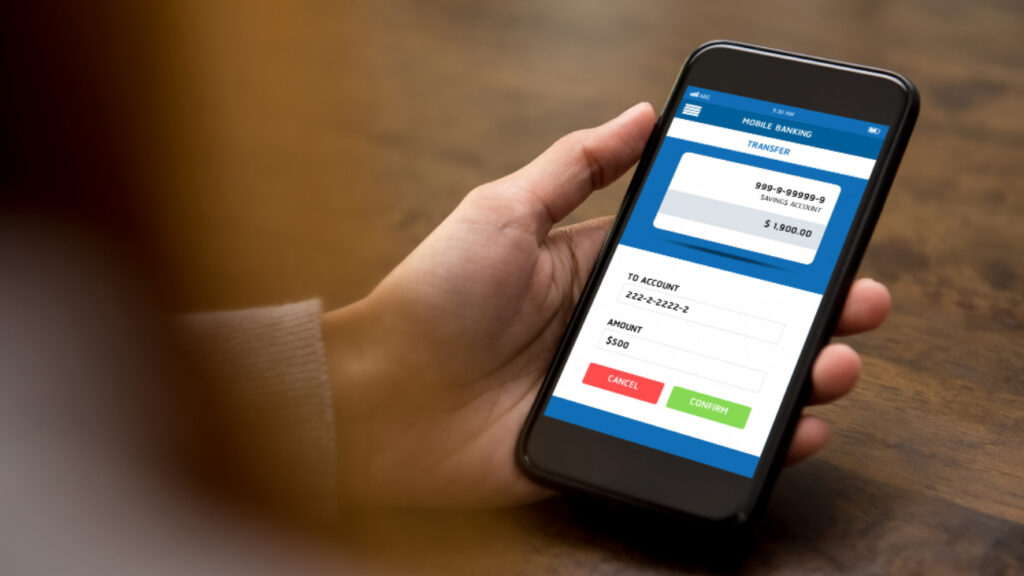

Technological advancements have revolutionized the banking sector, driving significant changes in how banks operate and serve their customers. The rise of digital banking, mobile payments, and blockchain technology has enhanced efficiency, security, and customer convenience. Banks increasingly invest in fintech innovations to streamline operations, reduce costs, and improve the customer experience.

These advancements enable banks to offer new services such as digital wallets, instant payments, and personalized financial advice. However, banks must also address the challenges of cybersecurity threats and the need for ongoing technological upgrades to stay competitive in this rapidly evolving landscape.

Regulatory Changes and Their Effects

Regulatory changes profoundly impact the banking industry, shaping everything from operational practices to compliance requirements. Governments and international bodies regularly update banking regulations to address emerging risks, protect consumers, and maintain financial stability. These changes often require banks to adapt their policies and procedures, invest in compliance infrastructure, and enhance transparency.

While stringent regulations can increase operational costs and limit certain banking activities, they also help prevent financial crises and build public trust. Banks must stay abreast of regulatory developments and proactively adjust their strategies to ensure compliance and mitigate potential risks.

Globalization and Cross-Border Banking

Globalization has expanded the scope of banking activities, enabling banks to operate across borders and tap into new markets. Cross-border banking facilitates international trade, investment, and capital flows, offering banks opportunities for growth and diversification. However, globalization also introduces complexities such as managing foreign exchange risks, navigating diverse regulatory environments, and addressing geopolitical uncertainties.

Banks must develop robust risk management frameworks and leverage global partnerships to capitalize on the benefits of globalization while mitigating associated challenges. Effective cross-border operations require a deep understanding of international markets and the ability to adapt to varying economic and regulatory landscapes.

Conclusion

Global economic trends significantly influence the banking sector, shaping its operations and strategic direction. By understanding the impacts of economic cycles, inflation, technological advancements, regulatory changes, and globalization, banks can better navigate the dynamic economic landscape. The ability to anticipate and respond to global economic trends remains a critical factor for success in the ever-evolving banking industry.

The article has been written by Bahaa Abdul Hussein and has been published by the editorial board of www.fintekdiary.com