We may think that mobile banking is quite new, but its history goes back to the last century. With the flourishing of the internet, mobile banking came right after internet banking. Therefore, its root can be traced back to as early as the late 90s.

A Short History of Mobile Banking

Before we got accustomed to smartphone banking and using mobile banking apps, we did have mobile banking systems. It was done through SMS banking and WAP banking services.

M-banking or mobile banking changed forever when Apple and Google developed their operating systems, namely iOS and Android. This was after 2010. Web-Based Technologies like JavaScript and HTML 5 helped to launch and evolve mobile banking applications.

The world’s first mobile banking application was announced in 2007 by the Bank of Scotland. In 2009, its customers could use the bank’s iPhone app for checking current account balances and recent transactions, in addition to getting quick statements through SMS. The bank launched a fully functional banking application in 2011, the world’s first such app. Blackberry and Android users could use the app too.

Evolution of Mobile Banking

Mobile banking has developed rapidly and today perhaps every country has multiple banking apps. All of these apps look and function differently from one another. The factors which contributed to the fast evolution of mobile banking are:

- Development of modern technology

- A massive increase in smartphone and application users

- Digital revolution or progressive digitization

- A shift in consumers’ preferences and needs

- Developing infrastructure of mobile money

- Easier access

- Competition between banks

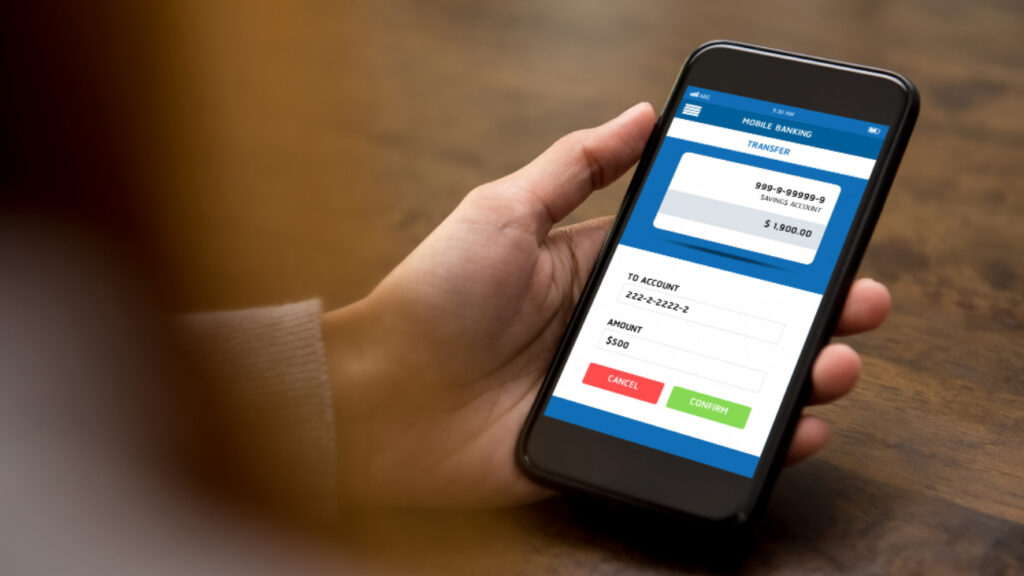

As a result, every bank has developed an app that their customers can use for banking on the go. Mobile banking apps are available on all operating systems and customers can carry out all kinds of financial work using the banking services. Now there is a plethora of contactless mobile payment platforms too, like Google Pay and other wallets. Additionally, there are now banking apps developed for smartwatches too.

The Future of Mobile Banking

In the future, the use of mobile wallets and mobile payments is going to increase owing to their convenience, speed, and safety. Mobile Banking’s future aims at developing savings tools and offering customers their financial wellness scores. Also, with the development of new technologies, mobile banking is only going to improve further. With the introduction and implementation of Machine Learning and AI (Artificial Intelligence), mobile banking apps will be able to introduce voice payments, Robo-advisors, and card control. Expect a better user experience, more security, and more user-friendliness from the future of mobile banking.

The article has been published by the editorial board of the Fintek Diary. Happy Reading. For more information please visit www.fintekdiary.com